Catcha Digital acquires TechNave to expand in consumer technology media

Kuala Lumpur, Malaysia – Catcha Digital Berhad has announced that its wholly-owned subsidiary, iMedia Asia Sdn Bhd, has entered into a conditional share sale agreement to acquire a 100% equity interest in Maxoom Sdn Bhd, the company that owns and operates TechNave.

The total cash consideration for the acquisition is RM6.125 million, comprising a completion payment of RM1.8 million on the completion date and a post-completion payment of RM4.325 million due 12 months later. The acquisition, which will be funded through internally generated funds, includes a net asset guarantee of RM885,000 at the completion accounts date.

The deal marks Catcha Digital’s entry into the consumer technology media sector and is expected to strengthen its position in Malaysia’s digital media landscape. The company said the acquisition is expected to be immediately value-accretive and contribute positively to its earnings through operational synergies.

TechNave is a multilingual digital media platform that covers consumer technology news, reviews, and trends across English, Chinese, and Malay. The company has a social media reach of over two million monthly users on Facebook and Instagram, and more than 1.5 million monthly views across YouTube and TikTok. It also maintains partnerships with global technology brands such as Samsung, Oppo, Huawei, Honor, and Xiaomi.

Catcha Digital said the acquisition would create opportunities for cross-platform collaborations and strengthen group-wide advertising solutions by combining TechNave’s technology-focused audience with iMedia’s lifestyle portfolio.

“We are thrilled to welcome TechNave to the Catcha Digital family. This acquisition is a key strategic move into the high-growth consumer tech vertical, securing a market leader that reaches millions as a premier multilingual source. Combining TechNave’s strong credibility and deep relationships with global tech brands with our iMedia lifestyle network creates a powerful new offering for advertisers. We are excited to work with the team to accelerate their growth,” said Patrick Grove, chairman of Catcha Digital.

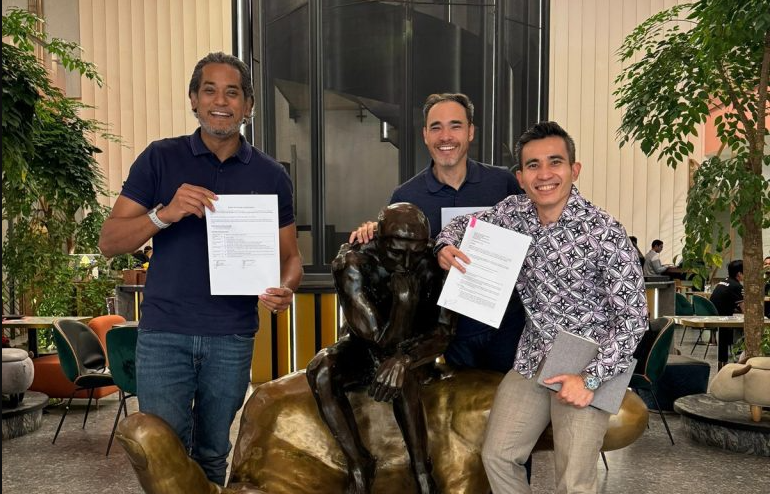

“Since founding TechNave, my co-founders and I have been dedicated to building Malaysia’s most trusted multilingual tech media platform. We are incredibly proud of the brand and the community that our team has established over the years. Joining Catcha Digital marks the perfect next chapter for the company. Their extensive network, digital expertise, and proven track record will provide the resources TechNave needs to scale to even greater heights, and we are confident they are the right partner to lead it into the future,” said Steven Boon, co-founder of TechNave.

Catcha Digital said the acquisition supports its broader strategy to become a leading digital group in ASEAN, targeting the region’s expanding digital economy, which Google, Temasek, and Bain & Company valued at approximately RM1 trillion in their 2024 SEA e-Conomy report.

The company has announced seven strategic acquisitions over the past year, each aimed at strengthening its position in the digital economy and contributing to future earnings, with a combined expected profit of around RM26.7 million over the next 12 months.

Catcha Digital acquires TechNave to expand in consumer technology media Read More »